Art as an alternative investment is soaring in popularity.

According to Artprice, art auction turnover was up by 5.3% in the first half of 2017 when compared against the same period in 2016. The U.S. saw a massive rise of 28% in auction turnover, with the UK rising by 13% and France up 7%.

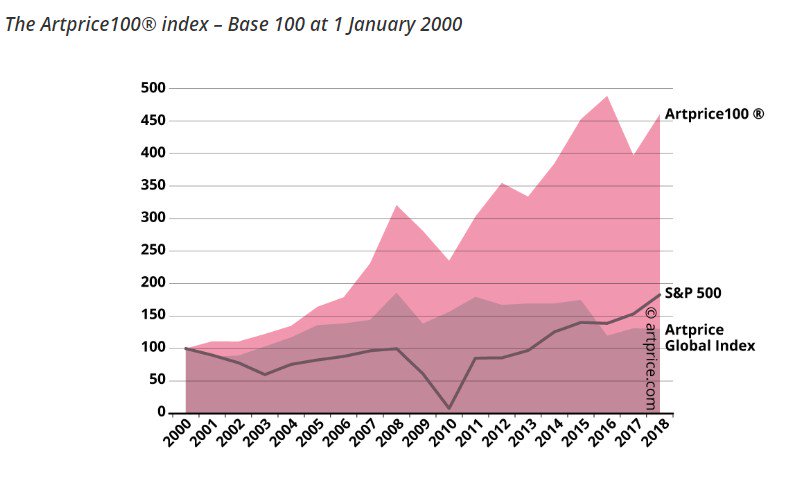

Art's growing popularity as an alternative investment is nothing new, though. The market has doubled in sales volume between 2002 and 2013, and specialists such as McKinsey Investment Group have pointed to the global financial crash in 2008 as a main driving point in recent years, alongside wider low global interest rates and other factors. Many private banks even now offer fine art investment advice, according to the Financial Times.

So, why is this particular medium so attractive as a diversified investment opportunity? There are a number of reasons why people choose art. These include the potential returns that can be made from blue-chip artworks, the fact that art typically holds its value better than other investment opportunities such as classic cars, and that it's a fun and exciting industry to be part of.

Ultimately, consider that Claude Monet's Houses of Parliament at Sunset showed a 177% rise in value between auctions in 2001 and 2015 and it's easy to see why art is such an attractive investment prospect.

Despite the returns that the right moves within the art market could provide to some investors as a diversified investment opportunity, though, it may still not be the right move for them from a personal, professional and - ultimately - financial point of view.

Discovering whether an alternative investment in art is right for you

So, what are some of the main reasons make people less inclined to invest in art? Just some of the most common pain points include:

1. The illiquidity of the investment

One of the main reasons that art can be such a great alternative investment opportunity is how it holds its value and appreciates over time. That's a double-edged sword though, and makes it quite an illiquid asset. Art is best suited for those who have the time to properly peruse and investigate market trends, and wait for their piece to accrue value in the long-term.

2. The risk potential

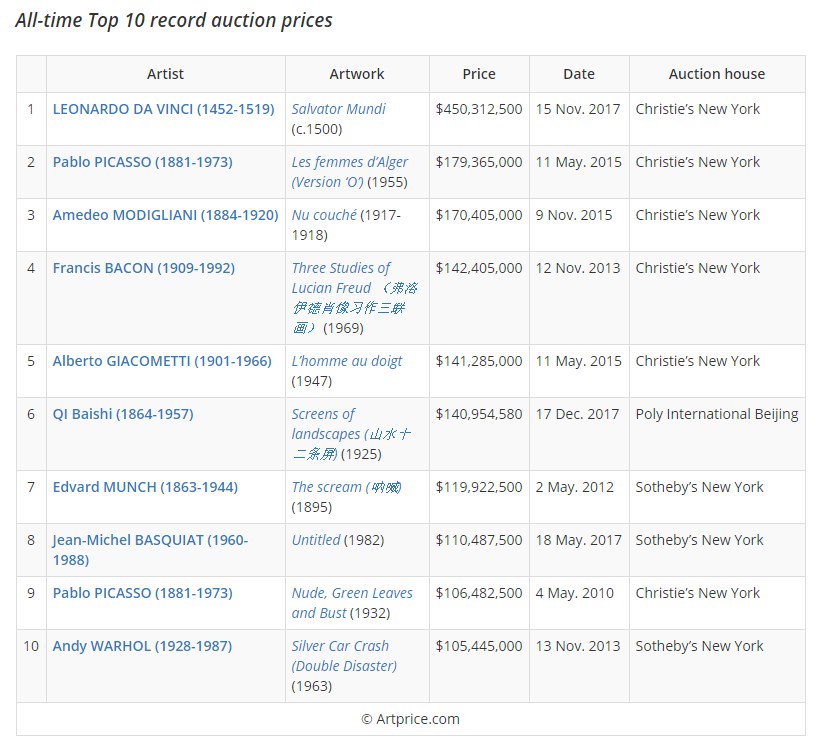

Though the potential is there for large returns, and though the market is showing signs of good health, art is like any investment opportunity and carries risks. Lower-value and more obscure pieces can represent a higher financial risk; unless you have the capital to invest in blue-chip pieces, which can cost millions at auction, it can be difficult to ensure your investments grow in value over time.

3. The barriers of entry to the market

Great art commands a high price, and the art market is very tightly controlled. Even if you were to raise the funds to consider art as a diversified investment, consider that galleries and auction houses take large commissions for their services. Working with them as middle-men can be a barrier to the average investor.

4. The cultural aspects

Is art really something you're interested in? Do you know your Picassos from your Warhols? Many people invest in art out of passion, and because to do so brings them pleasure as well as potential financial rewards. If you're investing simply because of the money and don't have a cultural interest in paintings or sculptures, then art may simply not be the right avenue for you to go down.

The challenges facing art lovers looking to get into the market

Some of the issues above are highly personal pain points. The cultural point especially - we always recommend that, if you're considering art as a diversified investment opportunity, know that any love, knowledge and passion you have for the medium will help you connect with the market and, ultimately, make wiser investment choices.

Some of the pain points, however, simply act as barriers for art lovers who'd like nothing more than to join the club and make an alternative investment in art. When you consider the high auction price of blue-chip artists, plus Christie's and Sotheby's charging as much as 25% on commissions, it's easy to see why some would be priced out of the market.

The current market represents a closed shop for millions. Art may be right for you, but as the landscape stands, another equally valid question may be "are you right for the art market?".

How Maecenas is changing the world of art investment

The Maecenas platform helps to navigate these pain points for investors, collectors, sellers and others who want to make inroads in the world of art as an alternative investment opportunity.

We do this by allowing investors to bid on fractional digital interests in blue-chip artworks, so they can own shares in masterpieces rather than the entire artworks themselves - all in a transparent and highly-secure way.

The Andy Warhol piece 14 Small Electric Chairs (1980) became the first-ever artwork to be successfully tokenised on the blockchain and sold in this way via Maecenas in 2018, with users bidding on digital shares in the artwork through the Maecenas Dutch auction process.

Not only did this help art lovers own their own piece of a genuine Andy Warhol, it also helped them become investors in a high-value blue-chip artwork.

Providing investors with the opportunity to own digital shares in lower-risk artworks can be a great diversified investment opportunity for those who by other means wouldn't be able to enter the art market due to cost. It also makes artworks more liquid - because those shares can be more easily traded than the artworks themselves - and makes provenance more easy to track thanks to the secure nature of the blockchain.

These are just some of the ways Maecenas can help people choose art as an alternative investment. Find out more about the platform by downloading our Art Investment Explainer Document.

Topics: Art Investment