Art as an alternative investment

Art is attracting more interest than ever in the world of alternative investments, with investors drawn to the potential for low risk and high returns. But how do you invest in a Picasso when you don't have $100 million to spare?

How do you invest in a Picasso when you don't have $100 million?

In July 2018, Christies International announced that it had sold $4 billion worth of art during the first half of the year. This represented a new six-month high for the auction house, and goes some way to showing the bullish nature of the wider art market.

A highlight was the sale of Peggy and David Rockefeller's collection in May 2018. The first evening of the auction had been expected to generate sales between $483 million to $531 million. In just one night, though, $646.1 million worth of artwork from the collection was sold, representing the highest total ever for a single-owner auction (the previous record was $484 million generated from the sale of Yves Saint Laurent and Pierre Bergé's collection in Paris, 2009).

This included the sale of Claude Monet's Nymphéas en fleur for $84.7 million (estimated at $50 million), as well as Pablo Picasso's Fillette à la corbeille fleurie for $115 million (estimate: $100 million).

In total, seven new records were set for artists regarded as blue-chip, including record sales for works by Claude Monet, Henri Matisse, Eugène Delacroix, Armand Séguin, Giorgio Morandi, Odilon Redon, and Jean-Baptiste-Camille Corot.

It's no surprise, then, that art is attracting more interest than ever in the world of alternative investments, with investors drawn to the potential for low risk and high returns compared to traditional assets (not to mention the prestige of owning a masterpiece).

The figures also tell another story, though. Art as an alternative investment can have a very high barrier to entry for most investors, both due to cost - how do you invest in a Picasso when you don't have $100 million? - and the fact that not everyone has the level of art industry expertise necessary to identify tomorrow's top-sellers.

Art in the context of alternative investments

World Economic Forum, there were only $1 trillion in alternative assets in 1999. By 2017, this had risen to almost $6.5 trillion, figures from

Willis Tower Watson reveal.

"[Alternative investment's] growth can be traced to a range of external factors, with regulatory changes, economic cycles, and technological developments, all playing critical roles."

World Economic Forum Alternative Investments 2020: The Future of Alternative Investments

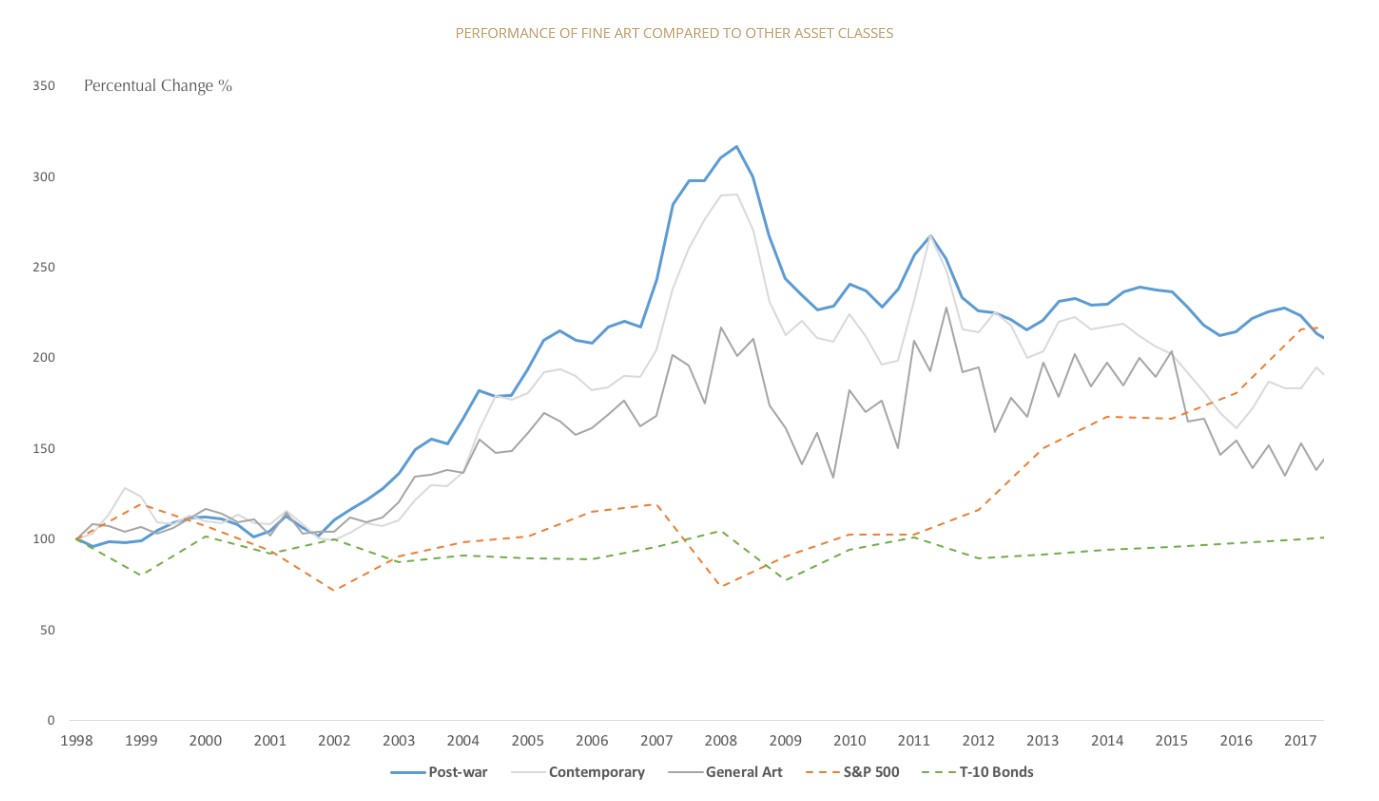

The art market is also one of the most popular areas where people looking for diversified investment opportunities are placing their funds. Fine art has consistently outperformed other asset classes over the years and continues to show its strength, especially against traditional investment avenues such as oil and coal which have seen periods of uncertainty over the last five years.

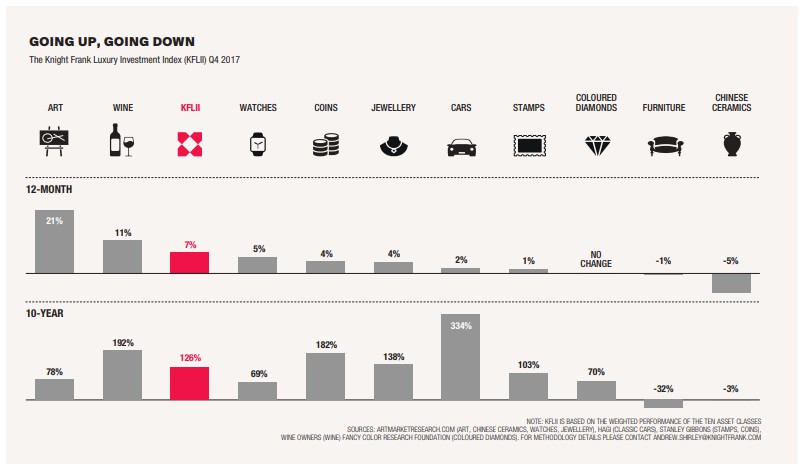

2018's The Wealth Report, published by Knight Frank and Douglas Elliman, supports that fact showing that, in 2017, high net-worth investors spent more on art as a diversified investment opportunity than wine for the first time in eight years.

The trend, according to the report, was spurred on by the $450 million sale of Leonardo's Salvator Mundi, and the $110.5 million sale of Jean-Michel Basquiat's Untitled.

"It was Christie's sale of Salvator Mundi by Leonardo da Vinci that really focused the world's attention on the art market. Some experts decried its condition, while others doubted whether it was even by da Vinci, yet that didn't stop a buyer from the Middle East deciding it was worth a staggering $450 million, smashing the previous world record of $179 million set by Picasso's Women of Algiers in 2015."

Knight Frank The Wealth Report

Returns aren't the only attraction to art as an alternative investment, either. Fine art is a popular way to store wealth and diversify a portfolio. As a luxury item, it also brings pleasure to its owners - not to mention status.

How blockchain will improve access to art as an alternative investment

Still, auction prices in the hundreds of millions represent a massive barrier to entry to most investors - as do many other aspects of the way the art market has traditionally worked.

Take the role of intermediaries, for example. The gallery and the auction house are currently indispensable to investors because of their knowledge of the market, their connections and insight into the art world, their ability to assess and value works, and their ability to assess the authenticity (provenance) of a work. But this expertise comes at a cost.

The art market is inaccessible for many, and has been this way for centuries. However, we believe blockchain has the potential to lower the barrier to entry - and that it can do this through asset tokenisation.

In simple terms, asset tokenisation allows investors to own fractional economic interests in items such as artworks rather than the whole asset. Thanks to the security and transparency of blockchain, tokenisation is now gaining momentum in an enormous range of real-world applications - one of which is art.

A lot of investors still believe the only way to enter the art market is to raise tens or hundreds of millions in funds to be able to compete at auction. Even then, there's no guarantee they won't be outbid by another affluent party.

The Maecenas platform, on the other hand, uses blockchain to tokenise artworks so fractional economic interests in those assets can then be bought and sold at much lower prices than a $100 million Picasso. We believe this will help improve access to the art market for individuals who wouldn't have had the funds to invest in the past.

Art as an alternative investment: How Maecenas is opening up the art world

The Maecenas platform launched in beta in June 2018. In July and August, investors were able to bid for shares in an Andy Warhol artwork - 14 Small Electric Chairs (1980), offered for sale on our platform by London gallery Dadiani Fine Art.

It wasn't only exciting for Maecenas because it was the first artwork to feature in an auction on the platform, but to also show how the entire Maecenas platform works as its own ecosystem in real-time.

Typically, when trying to buy a Warhol or work from a similar master, an investor would have to go to an auction house such as Christie's or Sotheby's (who have approximately 80% of secondary market volume). Investors cannot be 100% sure they're getting a fair price because houses such as the above control their information so tightly, while buyer's commissions as high as 25% aren't unheard of.

Maecenas' blockchain-powered platform will throw the doors open on that industry through the natural decentralisation apparent in the blockchain ledger. The auction process is more transparent; the bidding process is fairer; there are no intermediaries; more affordable ways to invest in art; increased liquidity and more, all while building a strong community of connected art enthusiasts.

FREE Art Investment Explainer Document

The Maecenas platform and wider ecosystem is powered by our very own cryptocurrency, the ART token. ART tokens are essential to using Maecenas and unlocking the advantages of the incorruptible, transparent and decentralised blockchain ledger.

ART tokens allow investors to bid for digital shares in famous artworks through our Dutch auction process which receives bids and issues shares through Ethereum technology. Dutch auctions are run through a smart contract which gives investors more price control, greater security and more transparency than a traditional auction. If successful, investors will have digital certificates of their share of the artwork, and also be able to arrange to view it.

Maecenas is more than a crowdsourcing platform. It benefits both buyers and sellers. Gallery owners and fine art collectors can raise capital, for instance, by offering digital shares in their art through Maecenas instead of taking out a large secured loan with high interest. Investors can use Maecenas to spread their funds in various available artworks or use their capital to bid for a share in a highly sought-after piece of art.

Maecenas has been created by financial technology experts alongside leading art advisors and historians to open up and democratise the entire art market. Maecenas is more than a blockchain start-up. Our team works directly with art collectors and galleries across the globe, building strong relationships not just to source some of the world's finest collections of art for investors, but for the benefit of the wider Maecenas community.

Want to find out how the Maecenas platform works in more detail and the advantages blockchain technology can bring to art investors? Fill in the form below to download our Art Investment Explainer Document.

Please read the following disclaimer >

This blog post is illustrative and for informative and general education and discussion purposes only. It is not, and should not be regarded as "investment advice" or as a "recommendation" regarding a course of action, including without limitation as those terms are used in any applicable law or regulation. This information is provided with the understanding that with respect to the material provided herein (i) MAECENAS is not acting in a fiduciary or advisory capacity under any contract with you, or any applicable law or regulation, (ii) that you will make your own independent decision with respect to any course of action in connection herewith, as to whether such course of action is appropriate or proper based on your own judgment and your specific circumstances and objectives, (iii) that you are capable of understanding and assessing the merits of a course of action and evaluating investment risks independently.. MAECENAS does not purport to and does not, in any fashion, provide tax, accounting, actuarial, recordkeeping, legal, broker/dealer or any related services. You should consult your advisors with respect to these areas and any material with regards to investment decisions. You may not rely on the material contained herein. MAECENAS shall not have any liability for any damages of any kind whatsoever relating to this material. No part of this document may be reproduced in any manner, in whole or in part, without the written permission of MAECENAS except for your internal and/or personal use. This material is being provided to you at no cost and any fees paid by you to MAECENAS are solely general educational purposes. All of the foregoing statements apply regardless of (i) whether you now currently or may in the future become a user of MAECENAS's platform or products and (ii) the terms contained in any applicable contract between you and MAECENAS.