Some of us start with stamps, others with coins. Regardless of the actual object or artwork, the urge to collect is common in all of us, but turning a childhood hobby into professional collecting takes desire, determination and dedication.

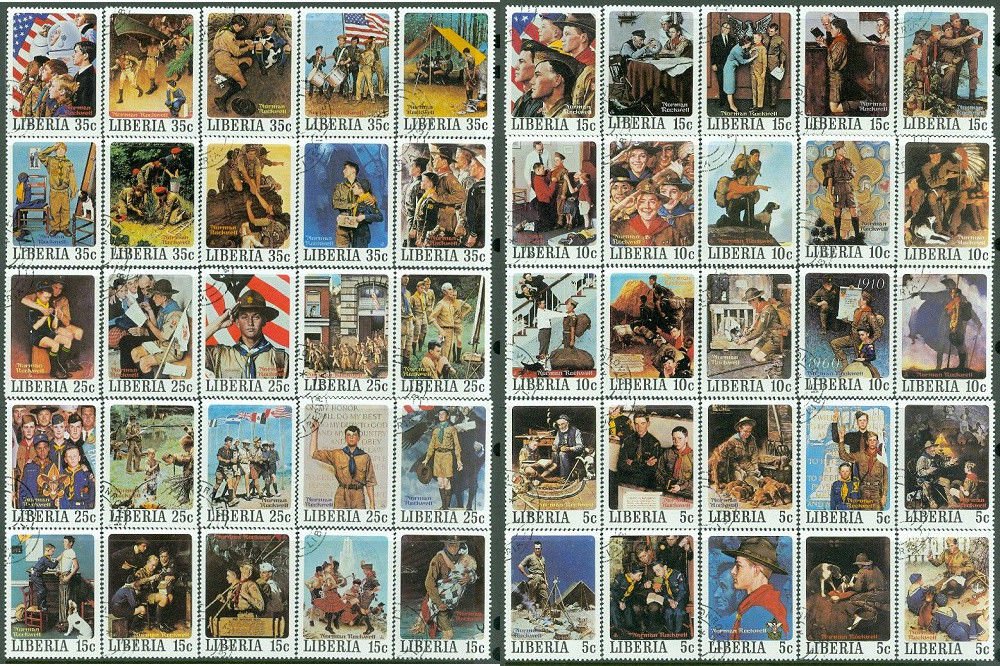

Norman Rockwell Boy Scout Painting Stamps Collection via Picclick

Norman Rockwell Boy Scout Painting Stamps Collection via Picclick

For centuries, collecting art has been more of a privilege for a select few. However, with the advent of the World Wide Web, buying art has become easier than ever before. A previously opaque market, where information access was limited to several key players and influencers, has now become more accessible, regulated and democratic. Consequently, the art market has evolved significantly over the past two decades, and artworks have become tangible assets not only for art enthusiasts, but also for financial investors. The "big four questions" have nonetheless remained the same when making the decision to start collecting art: Where, when, how, and what to buy?

Taking the plunge into collecting

Regardless of your background, collecting art is much more than just following instincts. Understanding what you like and educating yourself about a specific period or artist is just as important as defining your goals in collecting. Indeed, people collect art for various reasons. For some, art is pure investment, just like any other business. For others, it is more about prestige and pleasure, being at the forefront of contemporary culture. In any case, starting your collection begins with defining your personal taste.

What to buy?

Let's say you have decided to acquire a masterpiece by the world-famous Pablo Picasso. This would be a sound investment in a well-established artist with proven auction results. Naturally, you would have to invest a much larger sum, but it would be much less risky than investing in an artwork by an emerging talent.

Where and when to buy?

As discussed in our earlier blogpost, artworks could be purchased in the primary market, straight from the artist or from his/her representing gallery. In the case of Picasso, of course, this is not an option anymore. Therefore, we have to look for a work in the secondary market, where the seller could be a broker, a specialist dealer, a gallery or an auction house.

Finding a good work by Picasso would take a lot of research. From art fairs, to auction houses, from agents to private galleries, it is quite a task to find his works. Checking online marketplaces such as Artsy could also be helpful in finding the best possible deal. Luckily, more and more tools are now available to help with a collector's search. Only a few years ago, when a dealer gave us a price, we would have to trust him or her. Nowadays, with the existence of price databases, we have a good chance of finding supporting auction results. Artnet and Artprice both provide reliable information about sale prices.

What's next?

Collecting, however, does not end with just finding the desired piece. Behind-the-scenes administration always remains fundamental. Just as keeping our finances in order, it is equally important to keep some sort of registry of the works collected. Often overlooked, but later regretted, finding a good collection management program is critical to the longevity and relevance of any art collection. Keeping an inventory is a necessity rather than a luxury. An inventory detailing artworks' descriptions, sales receipts, provenance, consignment agreements, conservator reports, etc. would form the basis of collection administration. With several options available on the market, collectors can choose between multiple collection management software products, such as Collector Systems or Collectrium. (You can browse for several other options on the Capterra webpage.)

Once you have successfully kept all these points in mind, you will be well on your way to becoming a professional art collector.

Article featured image: Paul Cézanne "The Fisherman (Fantastic Scene)" (1875) via the Metropolitan Museum of Art.

Topics: Art Investment