Moving into the secondary from the primary market is typically key to an artist's commercial success and can often mean the difference between scraping by and international fame and fortune.

But how exactly does an artist transition from one to the other?

Let us take the example of Adrian Ghenie, a Romanian painter born in 1977 in Baia Mare. Ghenie grew up under the oppressive Communist regime of Nicolae Ceaușescu, where the structure and rules of a Western-style art market barely existed. Only a few artists could live off their works, and artworks were considered intellectual property rather than commercial goods. Very little changed after the fall of the Iron Curtain and it has taken many years to establish a quasi-healthy local art market.

Portrait of Adrian Ghenie by Oliver Mark, Berlin 2014, Collection of the Bukovina Museum

Ghenie was a student at the now-famous University of Art and Design in Cluj, and he was considered an extremely talented painter at a young age. His lush, vibrant and often large-scale paintings quickly became popular among his fellow students and teachers. Nevertheless, finding opportunities for gallery exhibitions in an economically struggling Romania were few and far between. Eventually, he decided to open his own art gallery with his friend, Mihai Pop in 2005. Commercial success and global recognition soon followed as he participated in more and more international art fairs, gaining contacts with foreign curators, including UK-based independent curator, Jane Neal, along the way. His works started to attract the attention of international collectors. In 2009, he famously sold a work to the mega-collector, François Pinault for approximately €60,000, through the help of the now-closed Haunch of Venison gallery in London.

Further solo and group shows followed, including exhibitions at the Museum of Contemporary Art Denver (2012-2013); the Stedelijk Museum voor Actuele Kuns (S.M.A.K.), Ghent (2010-2011); and the National Museum of Contemporary Art, Bucharest (2009-2010). This all helped make Ghenie more and more popular, to the point where he could no longer meet the growing demand of his collectors. For those unwilling to join the expanding waiting list, there were limited opportunities to collect Ghenie's paintings.

Recognising the increasing demand for Ghenie's works amidst his outstanding success, the leading auction houses quickly stepped in to secure consignments from owners willing to sell his artworks via auctions.

Once a painting has been acquired in the primary market directly from the artist or his gallerist and resold, it becomes a part of the secondary market.

Ghenie nor his gallerist remain in complete control of his prices. Instead auction houses' PR machines take over and the artist becomes part of a much larger market with a much wider range of potential buyers and sellers.

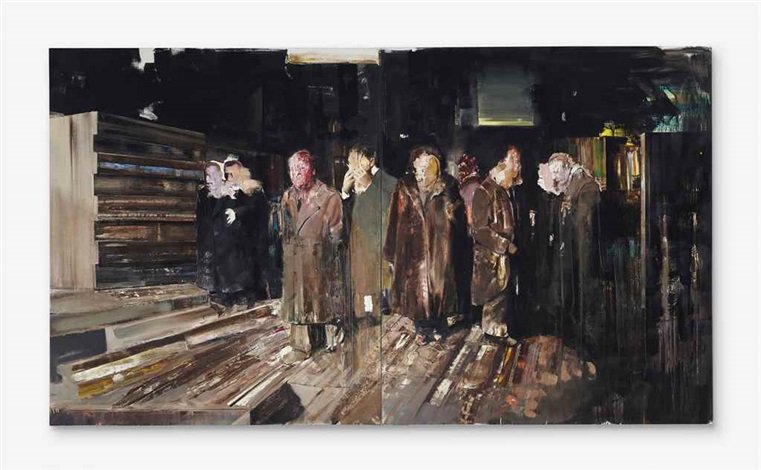

Remember the above-mentioned acquisition by François Pinault? The very same painting, titled "Nickelodeon" (2008), went under the hammer at Christie's London in October 2016. After a tense bidding war, the diptych was sold for an artist-record of £7.1 million, a price rise of 16,000%!

Adrian Ghenie's "Nickelodeon," a 2008 piece. Credit Adrian Ghenie, via Christie's Images Ltd. 2016

In less than ten years, despite hailing from a country lacking the structures of an operating art market, Ghenie has managed to become both commercially and critically acclaimed. Gaining gallery representation and selling his works in the primary market was the first step in validating his creative production. Being targeted by leading auction houses and entering the secondary market was the second step in his global recognition. Indeed, Adrian Ghenie represents the perfect success story of an artist transferring from the primary to the secondary market.

Topics: Art Investment