Art is a popular alternative investment opportunity, but how do you get in on the ground floor?

Before we start, it is important to underline exactly what makes some artworks so highly sought-after by investors.

The key word here is investment. Many are drawn to the market because of the returns that can be gained should an investor work hard to identify which paintings stand the most chance of rising in value over time.

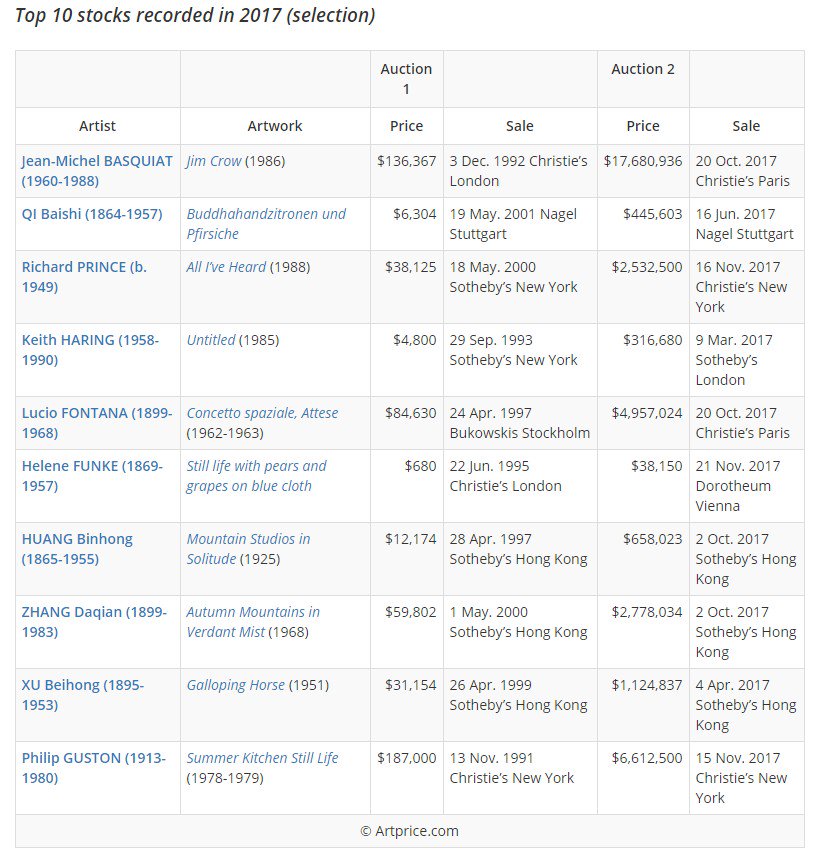

Reporting on the art market in 2017, Artprice unveiled statistics that do a remarkable job of illustrating this - showing why art can be such an attractive alternative investment if the right moves are made.

Consider Jim Crow (1986) by Jean-Michel Basquiat. In December 1992 it fetched $136,367 at auction. Last year, the painting sold for $17,680,936 at Christie's Paris.

Other notable stock sales throughout 2017 include All I've Heard (1988) by Richard Prince for $2,532,500 (auctioned for $38,125 in 2000) and Concetto spaziale, Attese (1962-1963) by Lucio Fontana for $4,957,024 (auctioned for $84,630 in 1997).

Figures such as these are one of the main reasons why art is such a popular alternative investment opportunity, but the truth is that sales like these are not flukes. A lot of planning goes into achieving such returns, and some of the things the most successful investors will bring to the table include a wealth of knowledge on the artist, artwork and dealer; understanding of the historical significance of the artwork and artistic movement it belongs to; and close relationships with dealers and taste-makers.

With all those things in mind, where is the best place to start when you're looking to make an investment?

3 tips on how to start investing in art

If the temptation to invest in the world of art is simply too strong to ignore, then we think it is essential to immerse yourself in the art world as much as possible by:

1. Learning the trade

The first tip is to take a step back and think about the art market as you would any other investment. You would not invest in, say, oil or gold without investigating market trends and other key factors, would you?

Knowledge is king when it comes to making a diversified investment in the art world. Engage with online resources such as Artnet and Artprice to get information on auctions and artist sales; read books about the market and the history of art as a whole; view live auctions on websites such as Christie's and Sotheby's. Become as familiar with the art world as you possibly can.

2. Being part of the conversation

There is only so much you can do online. To improve your chances of making a successful alternative investment in art, it helps if you build connections and form relationships with people on the front lines.

That means going to galleries, museums and exhibitions to meet with curators, other investors, professional art consultants and even artists themselves. Working through traditional channels and meeting the right people active in the art community will help you to make more educated and informed decisions when making a diversified investment in art.

3. Being careful with your finances

When starting out, it is not uncommon for people to make an alternative investment in a piece of art based on little more than a gut feeling. Not every piece of art accrues in value, though, and it is quite an illiquid medium. Be careful when starting out.

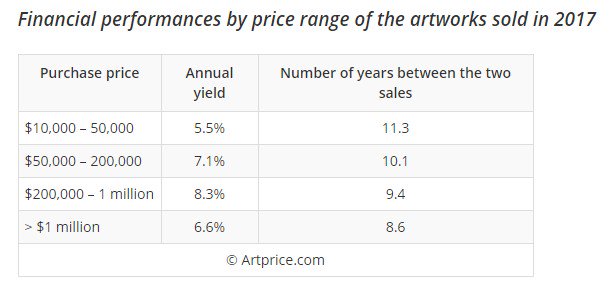

That being said, art is known for retaining its value in times of economic uncertainty. Like any other investment opportunity, it is wise to hedge your bets when initially building an art portfolio. When making a diversified investment in art, spread your capital around various artists based on information you have collected such as auction trends.

Should first-time investors look at alternative markets?

We feel those tips are amongst the most essential basics when people are looking at art as an alternative investment. As prepared as you may be though, there is a hurdle that many first-time investors simply may not be able to cross no matter how hard they try; the issue of capital.

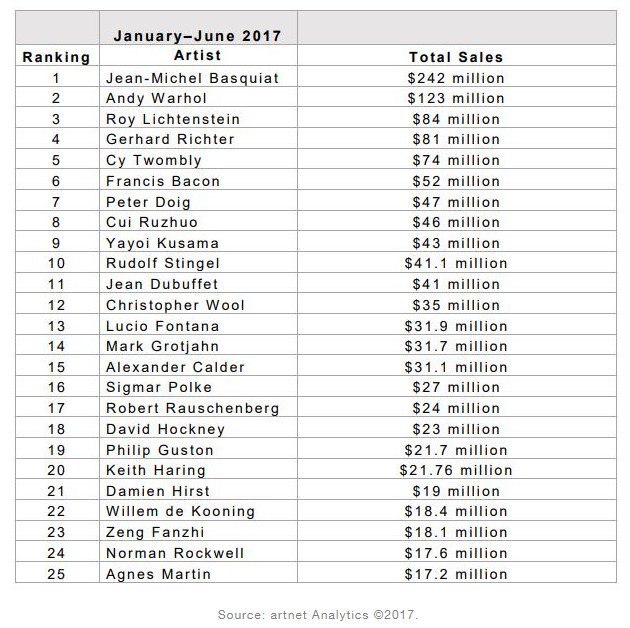

The art market can be very top-heavy, with a lot of money circulating around blue-chip names such as Picasso and Warhol. According to Artnet in 2017, 25 artists alone were responsible for almost half of all postwar and contemporary art auction sales at the time.

The Artnet report also demonstrates that blue-chip artists and artworks historically demonstrate the best returns. For many investors, that is simply a mountain too high to climb. The art world then can become something of a closed shop for the very wealthy with the power to make such high-value trades and purchases.

However, both seasoned and first-time investors can have access to blue-chip artworks and legally own shares of them through the Maecenas art investment platform.

Maecenas allows art lovers, investors, collectors, traders, artists and others to come together online to purchase digital shares in blue-chip artworks from the world's most recognised artists, democratising the art market and opening it up for everybody who wants to make a diversified investment in famous artworks.

Maecenas users, for instance, were able - for the first time in history - to bid on fractional digital interests in a genuine Andy Warhol artwork, 14 Small Electric Chairs. Utilising the Maecenas Dutch auction process, bidders were able to purchase a stake in a work by a blue-chip name in the world of art and own it as their very own.

Though it is still essential that you get the basics right when making an alternative investment in art, the Maecenas platform is opening up areas of the market that may traditionally be tougher to access, especially for first-time investors.

Find out more about how Maecenas works and how investors could potentially own shares in famous artworks by downloading our Art Investor Explainer document today.

Topics: Art Investment