Looking to make an alternative investment?

You are not alone. Alternative investments are catching on worldwide, with HSBC saying in its 2017 The Rise of Alternatives report: "Bond yields are far from returning to pre-crisis levels... An enhanced role for alternative assets seems likely to become a permanent feature of many investment strategies."

The same report points out that "pension funds in Australia, Canada, Germany, Japan, South Korea, Switzerland and the UK now have an average allocation of more than 30% to alternative assets".

When people look to make an alternative investment, the art market is one of the more popular destinations investors choose to visit. A key reason for this is that art is generally resilient when economic downturns hit, holds its value well, and is not affected by changes in interest rates.

That is not to say that art as a diversified investment opportunity is without its risks, though. It will not provide a stable income, for example, may be difficult to sell later down the line, and can be costly to store safely.

Why art remains one of the best diversified investment opportunities

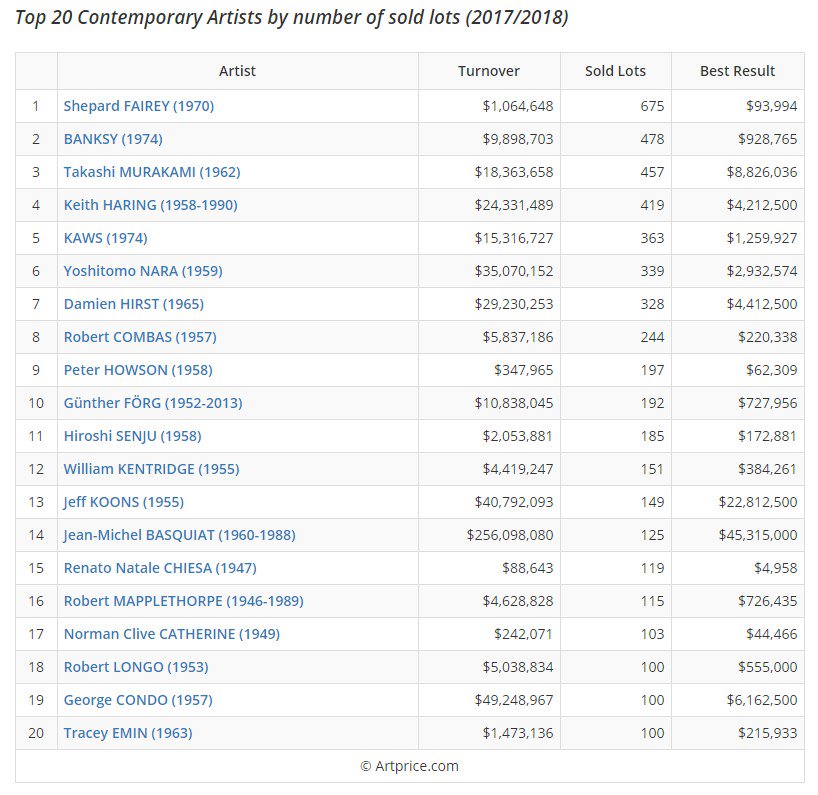

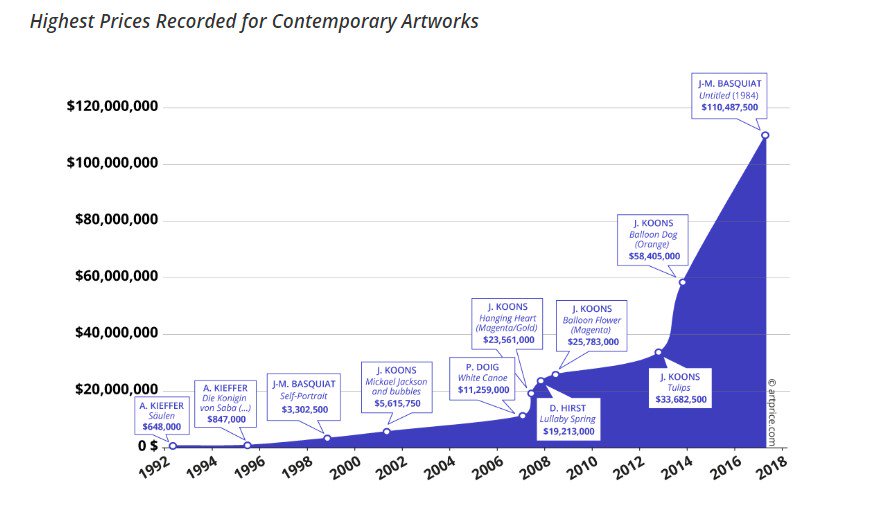

Still - for savvy investors, there is lots to be gained from art. According to the 2018 Contemporary Art Market Report, compiled by Artprice, the market for artworks created from the second half of the 21st century to the present day has seen 1,744% turnover growth in 18 years, with investors enjoying an 8.1% annual yield.

Today, the contemporary market continues to show good health, with the 12 months to June 2018 seeing an increase of 19% in global turnover and a 17% rise in lots sold.

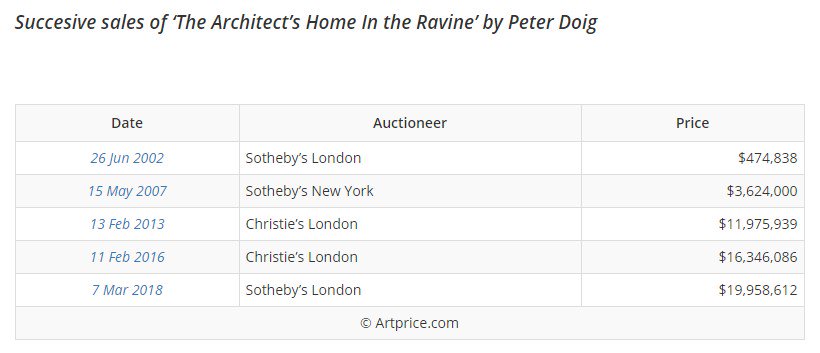

Consider the individual argument for making an alternative investment in art, too; in 2002, The Architect's Home In the Ravine by Peter Doig sold at auction for $474,838. In March 2018, it went under the hammer for $19,958,612.

Though art is a great investment opportunity, some can be put off by its high entry fees and oftentimes closed-shop status. So, what other alternatives are out there to consider as a diversified investment opportunity, and how do they stack up against art?

FREE Art Investment Explainer Document

Wine

A bottle of fine wine can represent a good low-risk alternative investment, with the market remaining relatively stable for the past five decades. Despite that though, unlike the art market, there can be some semblance of price volatility. Like the art market, too, it is worth talking to experts and doing a lot of background research before investing. Get it right and you could potentially see annual returns of 10%.

Property

Property is often regarded as the favourite alternative investment opportunity for people the world over. It can be profitable too - according to Totally Money, for example, some areas of the UK could provide average rental yields of 11.79%. Many external factors can hit second home owners hard, though. Removing mortgage tax relief in 2017 as well as rising stamp duty means, for many, being a landlord in the UK can be more trouble than it is worth.

Classic cars

Owning a classic car can be a diversified investment opportunity that is as fun as it is profitable. In 2017 the Telegraph reported that the market had grown by 192% over the past decade. The newspaper also reported that it had peaked in 2015, however, and that despite the positives, more vehicles entering the market had naturally depressed prices. Rarity can also provide a barrier too, with AXA finding that classic cars worth more than $1 million make up 40% of the market in terms of value despite accounting for just 2% of volume.

Commodities

Though commodities such as oil are regarded as more mainstream than an alternative investment opportunity, people are still choosing them to diversify their investments in stocks and bonds. Could they still be a wise place to put your cash, though? By way of example, oil prices have been extremely volatile for years and could sink lower in 2019, according to J.P. Morgan, with issues such as climate change affecting investors' appetites.

Renewables

Renewable energy is on the rise as a diversified investment opportunity. That could accelerate further with the UN's recent stark climate change warning. Despite the rising interest in renewables, though, are the returns really there? Many investment websites report that the average dividend yield for renewable energy projects is 5% - not small, but nowhere near the yields the right investment in art could potentially provide.

Art as the diversified investment of choice

All of those avenues are good options for people looking to share their capital in different, alternative ventures. However, those with knowledge and passion for art could find it a very attractive market to explore in terms of protecting their capital and making high returns.

Still, it is worth remembering when it comes to art that blue-chip artists and artworks historically demonstrate the best returns. This can be something of a double-edged sword for many investors, as it makes the financial barrier to entry extremely high. How can you stand to profit from an artwork as an alternative investment opportunity if you cannot afford it?

Maecenas is looking to change that landscape for investors interested in entering the world of art with our online platform that opens what is essentially a closed shop for many, democratising the art market and helping people to own fully-legal and binding digital shares in blue-chip artworks.

Our online community is able to invest in shares in some of the world's most famous artists and their works through a transparent and fair Dutch auction process. Recently, Maecenas helped numerous art investors to buy shares in the Andy Warhol piece 14 Small Electric Chairs - a world first that helped people become blue-chip art investors for the very first time.

Find out more about how Maecenas works and how it can help people diversify their capital into blue-chip artworks by downloading our Art Investor Explainer document today.

FREE Art Investment Explainer Document

Topics: Art Investment